Now that Pennsylvania has got its foot in the door, it’s time to address new questions and establish a strong presence in the online gambling market.

What This Means for PA Online Casinos Compared to Offshore Casinos

So, how exactly will PA online casinos fare against offshore casino sites?

Generally speaking, players are more inclined to play on legal and regulated online gambling sites than ones that are not. There are plenty of reasons for this, with the most important one being “safety”. Playing on a legal and regulated site is infinitely safer and involves less risk than playing on an unregulated site. We know this to be true because we’ve seen it happen already in New Jersey.

However, this is also assuming that the legal and regulated sites offer the same benefits as offshore sites.

At the end of the day, players are looking to win money. So, even if the site is legal, if it presents far less chance for a player to win, players are less likely to gravitate towards it versus offshore sites.

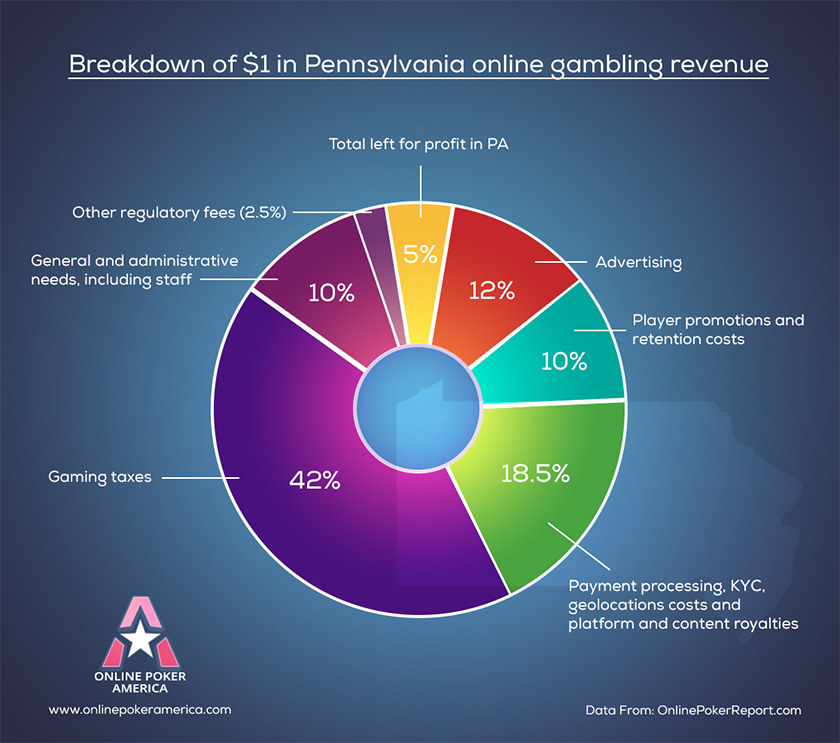

Here’s a comparison of how $1 of online casino revenue is spent in Pennsylvania and New Jersey:

For every $1 in online gambling revenue, Pennsylvania has to spend:

- 42{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on gaming taxes

- 18.5{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on processing payments, KYC, and royalties

- 10{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on basic administrative costs, such as salaries

- 2.5{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on other regulatory fees

- 12{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on Advertisement

- 10{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on promotions and player retention

- 5{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it will be taken as profit

For every $1 in online gambling revenue, New Jersey has to spend:

- 17.5{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on gaming taxes

- 18.5{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on processing payments, KYC, and royalties

- 12.5{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on basic administrative costs, such as salaries

- 2.5{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on other regulatory fees

- 24{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on Advertisement

- 20{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it on promotions and player retention

- 5{c118e36310c7bc75bef8f724f80ee0a52cfaf44be22f7e80906142f4c81518da} of it will be taken as profit

Based on those figures, although the profit potential is the same for both models, the difference is the amount of money PA has to spend on advertising and promotion compared to NJ.

What are the advantages? Will the tax rates be adjusted?

Read the full article on the dedicated Pennsylvania poker legality page.

-

Tags: